By Khurram Malik, Senior Director of Marketing, Custom Cloud Solutions, Marvell

While CXL technology was originally developed for general-purpose cloud servers, it is now emerging as a key enabler for boosting the performance and ROI of AI infrastructure.

The logic is straightforward. Training and inference require rapid access to massive amounts of data. However, the memory channels on today’s XPUs and CPUs struggle to keep pace, creating the so-called “memory wall” that slows processing. CXL breaks this bottleneck by leveraging available PCIe ports to deliver additional memory bandwidth, expand memory capacity and, in some cases, integrate near-memory processors. As an added advantage, CXL provides these benefits at a lower cost and lower power profile than the usual way of adding more processors.

To showcase these benefits, Marvell conducted benchmark tests across multiple use cases to demonstrate how CXL technology can elevate AI performance.

In December, Marvell and its partners showed how Marvell® StructeraTM A CXL compute accelerators can reduce the time required for vector searches used to analyze unstructured data within documents by more than 5x.

Here’s another one: CXL is deployed to lower latency.

Lower Latency? Through CXL?

At first glance, lower latency and CXL might seem contradictory. Memory connected through a CXL device sits farther from the processor than memory connected via local memory channels. With standard CXL devices, this typically results in higher latency between CXL memory and the primary processor.

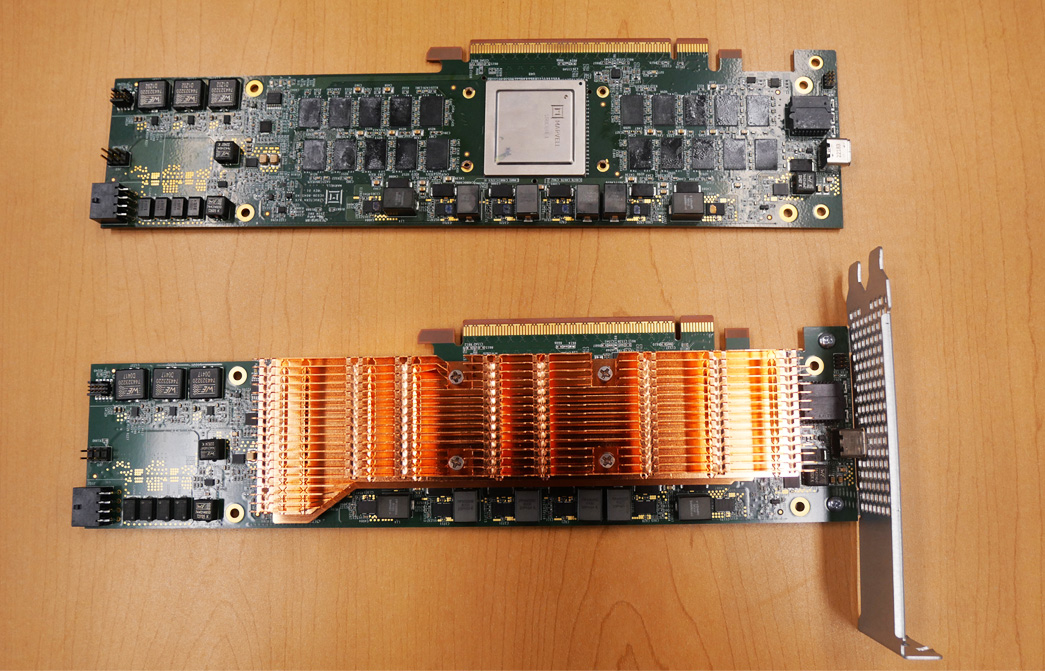

Marvell Structera A CXL memory accelerator boards with and without heat sinks.

By Sandeep Bharathi, president, Data Center Group, Marvell

This blog was originally posted at Fortune.

Semiconductors have transformed virtually every aspect of our lives. Now, the semiconductor industry is on the verge of a profound transformation itself.

Customized silicon—chips uniquely tailored to meet the performance and power requirements of an individual customer for a particular use case—will increasingly become pervasive as data center operators and AI developers seek to harness the power of AI. Expanded educational opportunities, better decision making, ways to improve the sustainability of the planet all become possible if we get the computational infrastructure right.

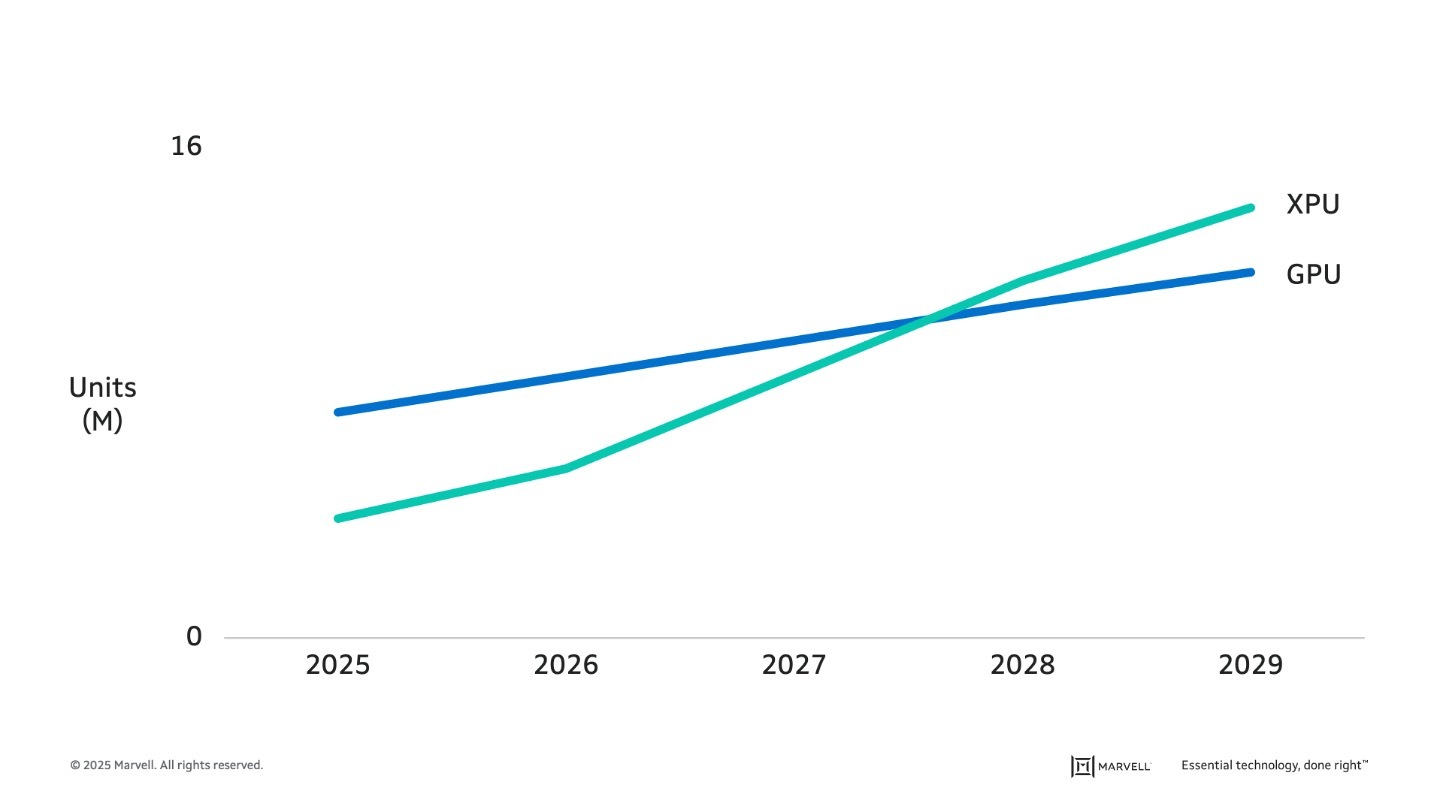

The turn to custom, in fact, is already underway. The number of GPUs—the merchant chips employed for AI training and inference—produced today is nearly double the number of custom XPUs built for the same tasks. By 2028, custom accelerators will likely pass GPUs in units shipped, with the gap expected to grow.1

By Michael Kanellos, Head of Influencer Relations, Marvell

The opportunity for custom silicon isn’t just getting larger – it’s becoming more diverse.

At the Custom AI Investor Event, Marvell executives outlined how the push to advance accelerated infrastructure is driving surging demand for custom silicon – reshaping the customer base, product categories and underlying technologies. (Here is a link to the recording and presentation slides.)

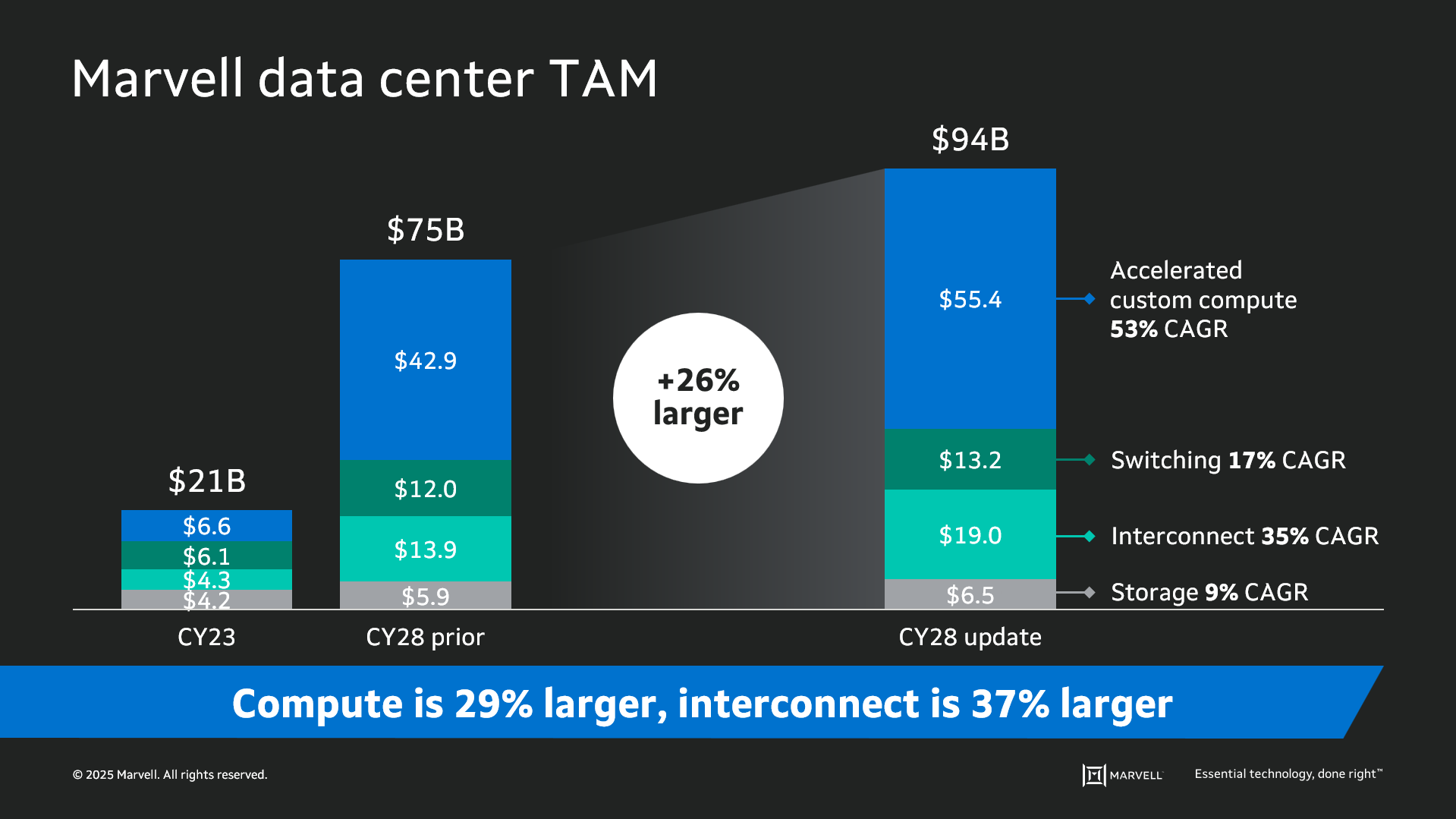

Data infrastructure spending is now slated to surpass $1 trillion by 20281 with the Marvell total addressable market (TAM) for data center semiconductors rising to $94 billion by then, 26% larger than the year before. Of that total, $55.4 billion revolves around custom devices for accelerated compute1. In fact, the forecast for every major product segment has risen in the past year, underscoring the growing momentum behind custom silicon.

The deeper you go into the numbers, the more compelling the story becomes. The custom market is evolving into two distinct elements: the XPU segment, focused on optimized CPUs and accelerators, and the XPU attach segment that includes PCIe retimers, co-processors, CPO components, CXL controllers and other devices that serve to increase the utilization and performance of the entire system. Meanwhile, the TAM for custom XPUs is expected to reach $40.8 billion by 2028, growing at a 47% CAGR1.

By Kirt Zimmer, Head of Social Media Marketing, Marvell

What do you get when you combine some of the world’s leading technology analysts with incredibly smart subject matter experts? Answer: the SixFive Media video podcast. It’s must-view content for anyone interested in understanding exactly how AI technologies are evolving.

At Marvell’s recent Investor Analysts Day, company leaders were happy to chat with Patrick Moorhead, CEO and Chief Analyst at Moor Insights & Strategy, and Daniel Newman, CEO and Chief Analyst at The Futurum Group. The resulting conversations (captured on video) were enlightening:

How Custom HBM is Shaping AI Chip Technology

Fresh off Marvell’s announcement of a partnership with SK Hynix, Micron Technology and Samsung Semiconductor, Patrick and Daniel dove into the details with leaders from those organizations. The partnership centers around custom high bandwidth memory (HBM), which fits inside AI accelerators to store data close to the processors.

Custom designs alleviate the physical and thermal constraints traditionally faced by chip designers by dramatically reducing the size and power consumption of the interface and HBM base die. Marvell estimates that up to 25% of the real estate inside the chip package can be recovered via customization.

Will Chu, SVP and GM of Custom Compute and Storage at Marvell, says the company estimates that the total addressable market (TAM) for data centers in 3-4 years is $75B. Last year it was $21B. Out of that, Marvell estimates that $40-43B is for custom accelerators.

Attached to that is custom HBM, which alleviates bottlenecks for AI workloads. In Dong Kim, VP of Product Planning at Samsung Semiconductor said, “Custom HBM will be the majority portion of the market towards the 2027-28 timeframe.” As Patrick Moorhead said, “The rate of change is phenomenal.”

By Kirt Zimmer, Head of Social Media Marketing, Marvell

Marvell’s business is accelerated infrastructure for the AI era, which is a fast-evolving space that can occasionally confuse even the most earnest student. To help you keep up, we’ve partnered with VentureBeat to explore a multitude of content about that subject: